Best Price LTM4700EY#PBF One Spot Buy BOM Service Original IC Chip Non-Isolated PoL Module DC DC Converter 2 Output 0.5 ~ 1.8V 0.5 ~ 1.8V 50A, 50A 4.5V – 16V Input

Product Attributes

| TYPE | DESCRIPTION |

| Category | Power Supplies – Board MountDC DC Converters |

| Mfr | Analog Devices Inc. |

| Series | µModule® |

|

|

Tray |

| Standard Package | 66 |

| Product Status | Active |

| Type | Non-Isolated PoL Module |

| Number of Outputs | 2 |

| Voltage – Input (Min) | 4.5V |

| Voltage – Input (Max) | 16V |

| Voltage – Output 1 | 0.5 ~ 1.8V |

| Voltage – Output 2 | 0.5 ~ 1.8V |

| Voltage – Output 3 | - |

| Voltage – Output 4 | - |

| Current – Output (Max) | 50A, 50A |

| Applications | ITE (Commercial) |

| Features | OCP, OTP, OVP, UVLO |

| Operating Temperature | -40°C ~ 125°C |

| Efficiency | 90% |

| Mounting Type | Surface Mount |

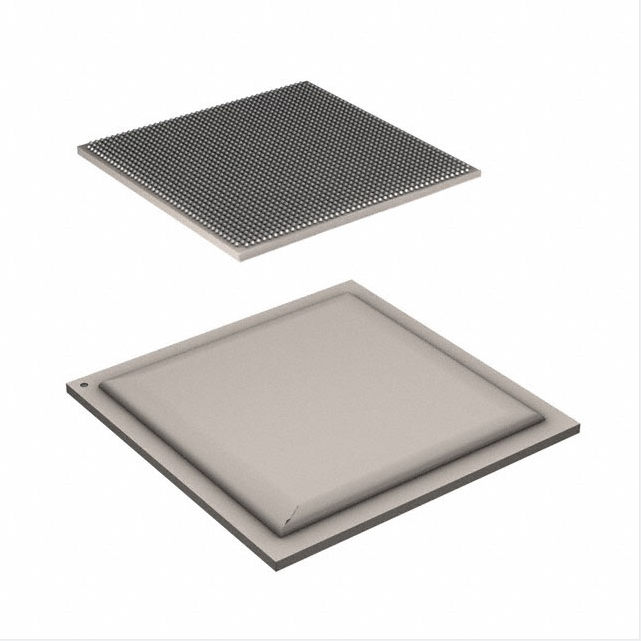

| Package / Case | 330-BBGA Module |

| Size / Dimension | 0.87″ L x 0.59″ W x 0.31″ H (22.0mm x 15.0mm x 7.9mm) |

| Supplier Device Package | 330-BGA (22×15) |

| Control Features | - |

| Approval Agency | - |

| Base Product Number | LTM4700 |

Leaders are far ahead in various segments of the analog chip market

Among the analog ICs, power management is the largest market at around US$21.6 billion or 42%; the signal chain market is US$14.3 billion (28%) and the RF and other products market is around US$15.8 billion, or 30%. In the amplifier segment, Texas Instruments holds almost a third of the market (29%), with ADENO second (18%). In the data converter segment, ADENO is the absolute leader, currently holding half of the data converter market (48%) and has a long-term lead over its competitors. In power management, the leader, Texas Instruments, holds more than a quarter of the market (21%), with Qualcomm (15%), ADENO (13%), Maxim (12%), and Infineon (10%) having a similar share.

Today, the downstream market for signal chains has a small consumer electronics share. in 2015, the downstream of op-amp chips were mainly in communications (36%) and industrial (33%), with consumer electronics accounting for only 8%. The downstream market for data converters likewise accounted for over 50% of sales to the industry, while consumer electronics accounted for only 12%.

The electronics industry, in our view, has always been a technology growth driven by demand. The main demand for signal chains is interaction, in the early days of the development of analog chips in the 60s and 70s, signal chains are mainly used downstream of industry, industrial equipment connected to computers as well as aircraft avionics systems, to play the function of industrial equipment, flight equipment and the interaction with the outside world. For example, aircraft have a large number of sensors to assist in flight, which need to be processed by signal chain products before being sent to the digital system. At the same time, integrated products are more likely to reduce size and cost. As a result, the demand for signal chains in the industry in the 1960s and 1970s drove the growth of early analog giants such as ADI and Texas Instruments. In the 1980s-2000s, the demand for interaction in consumer electronics went from strength to strength, likewise driving the growth of the signal chain downstream in consumer electronics.

The consumer electronics market is characterized by rapid product change and cost priority, so compared to the high precision sought by the industrial market and the high speed sought by the communications market, the demand in the consumer electronics market is for lower cost and shorter design cycles, and integrated signal chain products are better suited to meet demand than discrete ones.

In the last decade, the demand for consumer electronics in interaction has had a limited role in continuing to drive up the complexity of the signal chain. That is, 1) from the performance point of view, integrated data converter microcontrollers have been able to meet the performance requirements of most consumer electronics. 2) from the cost point of view, due to the increased functionality of mobile phones, increased integration can better reduce energy consumption. 3) from the design cycle, discrete data converters, although higher performance, but the complexity of the system design requirements greater, consumer electronics manufacturers need to consider a range of speed, resolution, power consumption, and other issues, if all use discrete signal chain chip, will be difficult to adapt to the rapidly changing market demand.

As a result, over the last decade, more signal chain products for consumer electronics have been integrated into microcontrollers/SoCs, resulting in statistically flat growth in this downstream market for consumer electronics.

Changes in product mix: power management benefiting from growth in consumer electronics and industry

Since the 1990s, the share of signal chain products has gradually decreased. in 1981, operational amplifiers accounted for 19% of the analog chip market, while in 2018 this figure was reduced to 6% and the market grew from just $200 million to $3.5 billion. Digital-to-analog converters likewise, from 1981 to 2018, the share of digital-to-analog converters in analog chips decreased from 19% to 6%, and the market size grew from US$300 million to US$3.9 billion.

Power management chips, on the other hand, have grown rapidly since the 1990s, growing into a major sector of the analog chip industry. in 1981, the market for power management chips was just $100 million, and today, it has grown into a $25 billion industry. The share of power management chips in the analog chip market has rapidly increased from 8% in 1981 and 9% in 1995 to 43% today (2018).

We believe that this is driven by continued new demand for power management in the consumer sector. The development of low-power, low-mass, and portable devices has led to the development of power conversion efficiency technologies and requirements.

The demand for low-power savings in consumer electronics is driving the growth of the power management chip industry. With the addition of new features to consumer electronics, audio, video, etc., consumer electronics continue to become more complex. Not only is the power consumption of electronic products increasing with each passing day, but the number of voltages that need to be supported is also becoming greater, objectively requiring power management chips that can increase energy conversion efficiency, and increase standby time while improving integration to support multiple voltages. In addition, as the development of the power density of lithium batteries has slowed down, so the only way to seek a breakthrough is from the power management chip. Therefore, the development of consumer electronics continues to drive analog chip manufacturers to introduce power management chips with more complex functions, higher efficiency, and lower volume, promoting the growth of the power management chip industry as a whole.

The demand for power saving in large power-consuming devices in the industrial sector has also driven the growth of the power management chip industry. Energy consumption in the industrial sector mainly comes from motors and lighting. Motors are mainly pumps, fans, compressors, transmission machines, etc. The energy consumed by motors accounts for almost 80% of industrial power consumption. Therefore, the demand for energy saving in the industrial sector has prompted power management chips to continuously improve conversion efficiency. For example, the use of variable-speed motors can save up to 40% of energy consumption, and the use of highly efficient switching power supplies can save up to 35%, all backed by more advanced power management chips.

In the future, new demands will continue to drive the development of power management, from the initial simple logic control of LED lighting to the more personalized requirements of today’s dimming and color changing, putting forward more complex and intelligent control requirements for power chips. In addition, some equipment to adapt to the trend of portability, equipment power supply from the adapter power supply to battery power, bringing many battery-powered systems chip demand.

Changing business models: the rise of application-based chips reduces the importance of self-built fabs

The structure of the standard and application-based analog chips is opposed in terms of the shipment volume and market size. In terms of shipment volume, the share of standard analog chips (64%) is much higher than that of special application analog chips (36%), but in terms of market size, it is special application analog chips (62%) that are higher than standard analog chips (38%). Share.

We believe that application-based analog chips face customized demand with higher added value. Process and architecture design are the two main approaches to performance improvement in analog devices. Standard analog chips are generalized, with designs varying little from manufacturer to manufacturer, resulting in low added value. Competition between manufacturers relies more on process and technology and requires a lot of self-built fabs.

Standard analog chips face the demand for low-cost and low-volume generalization and therefore focus more on the process. Low cost is achieved mainly by shortening the chip process to reduce the line width, thus enabling smaller sizes and lower costs with the same performance. In the early days, the main demand for analog chips was for standardized general-purpose chips, for example, ADI accumulated significant process advantages through rapid investment in building plants in the 80s and 90s.

Application-oriented analog chips were faced with widely varying needs, and thus were more design-oriented and had higher added value. In later years, as the complexity of electronic systems increased, specialized customization for a particular type of segment became more important, particularly in the industrial sector where many customers had inconsistent requirements in terms of speed, accuracy, integration, cost, and size, requiring analog chip manufacturers to make trade-offs to achieve an overall optimum, which required experienced R&D staff to design. Building their fabs to upgrade processes became less important and as a result, after 2000, ADI’s capital expenditure as a percentage of operating cash flow was greatly reduced and most chips were found using TSMC foundries.

In the future, application-based analog chips will drive a boom in fabless vendors. The emergence of foundries such as TSMC and SMIC has enabled chip companies to avoid the massive burden of building fabs and focus on the chip applications themselves, leading to the creation of several excellent fabless (Fabless) fabs. Mainland China’s IC design output grew from US$5.66 billion in 2010 to US$24.75 billion in 2016, a compound annual growth rate of 28%, and the number of fabless companies increased from 569 in 2012 to 1,362 in 2016. In the future, as the demand for application-based chips increases in various industries, fabless companies with excellent design and development capabilities are expected to stand out.