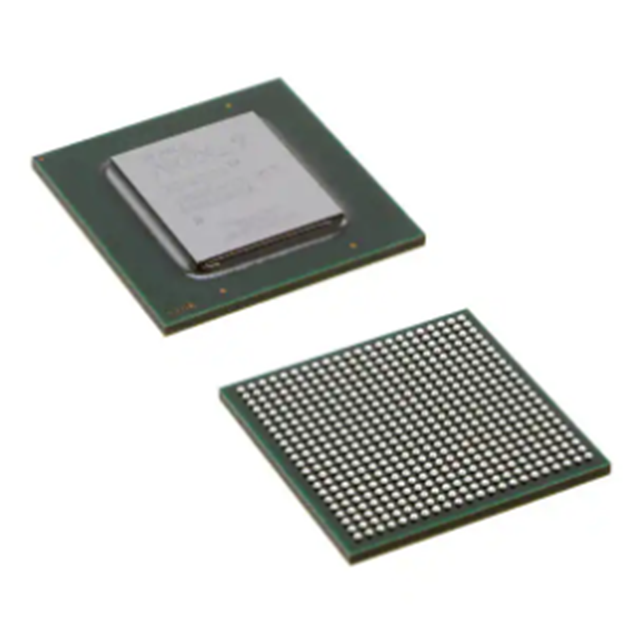

EP2AGX65DF25C6G new&original ic chips integrated circuits electronic components best price one spot buy BOM service

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs) |

| Mfr | Intel |

| Series | Arria II GX |

| Package | Tray |

| Standard Package | 44 |

| Product Status | Active |

| Number of LABs/CLBs | 2530 |

| Number of Logic Elements/Cells | 60214 |

| Total RAM Bits | 5371904 |

| Number of I/O | 252 |

| Voltage – Supply | 0.87V ~ 0.93V |

| Mounting Type | Surface Mount |

| Operating Temperature | 0°C ~ 85°C (TJ) |

| Package / Case | 572-BGA, FCBGA |

| Supplier Device Package | 572-FBGA, FC (25×25) |

| Base Product Number | EP2AGX65 |

Shanghai Fudan Research Report: FPGA Leader Continues High Growth, Technology Leads + Sales Complement

1. Shanghai Fudan: China’s leading IC design company with the continuous rapid growth of FPGAs

Founded in 1998, Shanghai Fudan is a leading manufacturer in China focusing on digital chip design and chip testing. In 1998, the company started its business in special circuits for telephones, motorcycle ignition pulse generators, and automobiles, and in 1999, it launched 8K memory card chips and was successfully listed on the Hong Kong GEM Board in 2000. In the five years after the successful listing in Hong Kong, the company successively launched smart card chips, energy meter MCUs, RFID chips, and cell phone SoC chips, successfully entering the financial, transportation, and consumer electronics markets; the company launched NFC control chips for public transportation card in 2015. In 2017, our SLC NAND Flash and NOR Flash products achieved a double breakthrough in R&D and volume sales. In 2020, the company launched China’s first 28nm PSoC chip. In the future wave of domestic replacement of FPGA chips, Shanghai Fudan is expected to be the leader in China.

Fudan’s background is significant, and the equity incentive ensures the long-term stability of core technical staff. Shanghai Fudan’s chairman of the board, vice president, chief engineer, and deputy chief engineer have all worked at Fudan University, and the product director and security lab director have also worked at Shanghai Fudan for a long time. Therefore, the core management of Shanghai Fudan has a strong background in Fudan University. The team members have rich industrial experience, excellent management level, and a profound technical level.

Shanghai Fudan has a relatively decentralized shareholding and is backed by the Shanghai State-owned Assets Supervision and Administration Commission and Fudan University. As of June 30, 2022, the company’s largest shareholder is Shanghai Fudan Fudan Science and Technology Industry Holding Company Limited, which is 70.2% owned by Shanghai SASAC, and the second largest shareholder in Shanghai Fudan High Technology Company, which is 100% owned by Fudan University. The stable and strong state-owned capital has laid the foundation for the company’s development in the IC design field with high technology barriers. The employee stock ownership platform enhances the long-term stability of the management and technical teams. According to the company’s announcement, the company’s current executives hold a total of 27.207 million shares, accounting for 3.34% of the company’s total share capital. The Company has 4 employee shareholding platforms, namely Shanghai Shengteng, Shanghai Yutang, Shanghai Xuling, and Shanghai Trench, with 150 employees participating in the shareholding, accounting for 9.8% of the total number of employees of the Company, holding a total of 35.172 million shares, accounting for 4.32% of the total share capital of the Company.

The company has 5 major businesses and 4 major product lines. The company has four product lines: security and identification chips, non-volatile memory, smart meter chips, and field programmable gate arrays (FPGAs). The company has built a long-term and solid cooperation relationship with upstream and downstream manufacturers in the industry chain. The company’s products have been successfully introduced to Samsung, LG, VIVO, Haier, Hisense, Lenovo, and other well-known manufacturers outside China, and its highly reliable products such as FPGAs are highly recognized by customers.

The company’s revenue will increase steadily from RMB 1.424 billion to RMB 2.577 billion in 2018-2021, and the net profit will be RMB 105 million, RMB 163 Million, RMB 133 million, and RMB 514 million from 2018-2021, respectively. In 2019, increased competition in the semiconductor market led to a decline in the prices of the company’s products, especially storage products, and a decline in gross margins combined with high investment in research and development led to a loss. According to the company’s announcement, starting from the launch of 28nm billion gate FPGA chips in 2018, the company’s annual average FPGA-related chip shipments exceed 60 million. With the industry boom and strong demand in 2021, the company’s four major product lines are selling well, with revenue growing 52% year-over-year.

FPGA and smart meter MCU revenue accounted for an increase in the product mix. According to the company’s announcement, in 2021, the company’s FPGA chip and smart meter MCU chip revenue will be 427 million yuan and 295 million yuan respectively, accounting for 12% and 17% of the company’s total revenue, an increase of 4 percentage points and 6 percentage points respectively from 2018. The Company has been actively developing FPGA chip products, and its revenue share continues to increase.

Profitability is significantly improved, and FPGA chips contribute high gross profit. According to the company’s announcement, the decrease in gross profit margin in 2019 is mainly due to the decrease in the gross profit margin of security and identification chips and non-volatile memory products, which, together with the company’s high R&D and management expenses, resulted in a loss in net profit for the year. In 2021, the gross margin reached 58.91%, an increase of nearly 13 points year-on-year. The company’s latest 2022H1 results show that the gross margin has further increased to 65.00%. By product, FPGA and related chips have the highest gross margin, with a stable gross margin level of over 80% in the past two years. Benefiting from the high boom of the semiconductor industry, the gross margins of the company’s other three major product lines will increase by 10 to 20 points in 2021 compared to 2020.

.jpg)