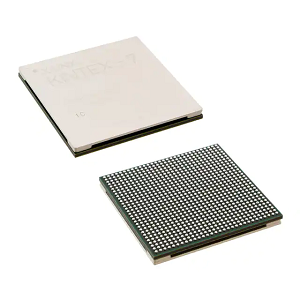

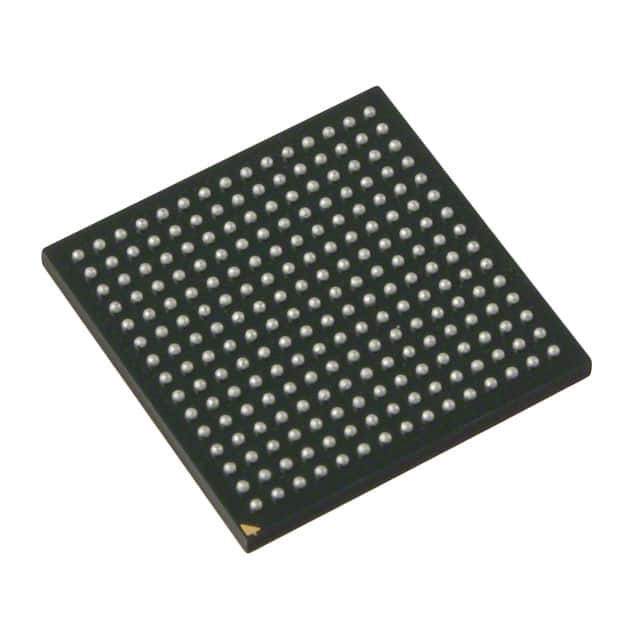

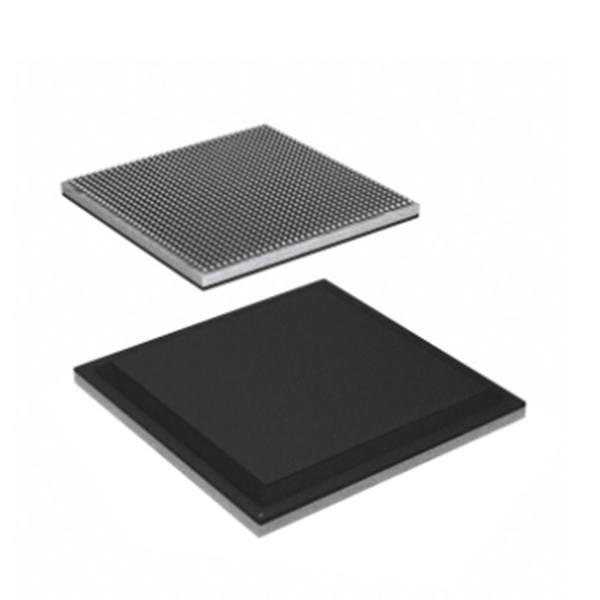

Microcontroller XC7S6-2CSGA225I IC FPGA 100 I/O 225CSBGA electronics components IC chips integrated circuits BOM Service

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs) |

| Mfr | AMD Xilinx |

| Series | Spartan®-7 |

| Package | Tray |

| Standard Package | 1 |

| Product Status | Active |

| Number of Logic Elements/Cells | 6000 |

| Total RAM Bits | 184320 |

| Number of I/O | 100 |

| Voltage – Supply | 0.95V ~ 1.05V |

| Mounting Type | Surface Mount |

| Operating Temperature | -40°C ~ 100°C (TJ) |

| Package / Case | 225-LFBGA, CSPBGA |

| Supplier Device Package | 225-CSPBGA (13×13) |

| Base Product Number | XC7S6 |

Xilinx’ Q3 FY2022 results, released before the acquisition, showed that the data center segment accounted for 11% of the company’s revenue, with its share increasing steadily each quarter and an annual growth rate of 81%.

To some extent, FPGAs themselves have gone to a new divide. Some chip watchers told reporters that the market demand for pure FPGA chips is already on the decline, and in the future, its embedded heterogeneous solutions fused with CPUs and DSPs will become the mainstream of the market, which will be beneficial in areas such as data centers, 5G and AI.

This is also reflected in AMD’s acquisition blueprint, where the company describes that Xilinx’ leading FPGAs, adaptive SoCs, artificial intelligence engines, and software expertise will empower AMD to bring a superb portfolio of high-performance and adaptive computing solutions. and capture a larger share of the approximately $135 billion cloud, edge computing, and smart device market competition through 2023.

AMD also mentioned the support that the acquisition of Xilinx would bring to the technical and financial aspects of the company.

On the technology side, it will strengthen AMD’s capabilities in chip stacking, chip packaging, Chiplet, etc., as well as provide a better software platform for AI, special architectures, etc.

On the financial side, the 67% gross margin performance of Xilinx will also optimize AMD’s financial model because of its long-cycle, high-margin market products. The deal is expected to deliver margin, cash flow, and other gains for AMD in the first year.

Technology integration still needs time

Some industry insiders are bemoaning the fact that after the acquisition, the name “Xilinx”, a small giant in its niche, may be replaced more by “AMD”.

According to the disclosure, after the acquisition, Victor Peng, former CEO of Xilinx, will be the president of the newly established Adaptive and Embedded Computing Group (AECG), which will remain focused on driving the FPGA, adaptive SoC, and software roadmap.

On the same day, AMD also announced new board appointments. Zifeng Su has added the position of Chairman of the Board to his previous positions of President and CEO; Jon Olson, formerly a director of Xilinx, and Elizabeth Vanderslice will join AMD’s Board, the former as CFO of Xilinx and the latter with investment banking and acquisition experience.

Although the amount seems huge, there is a precedent for this acquisition by AMD.

.png)