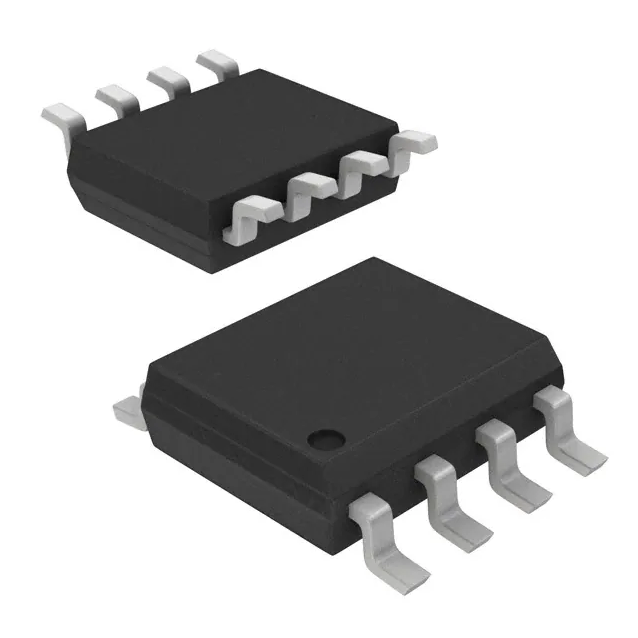

New and original ADUM1250ARZ-RL7 Integrated circuit Ic electronics components One Spot Buy DGTL ISOL 2500VRMS 2CH I2C 8SOIC

Product Attributes

| TYPE | DESCRIPTION |

| Category | Isolators |

| Mfr | Analog Devices Inc. |

| Series | iCoupler® |

| Tape & Reel (TR)

Cut Tape (CT) Digi-Reel® |

|

| Standard Package | 1000 |

| Product Status | Active |

| Technology | Magnetic Coupling |

| Type | I²C |

| Isolated Power | No |

| Number of Channels | 2 |

| Inputs – Side 1/Side 2 | 2/2 |

| Channel Type | Bidirectional |

| Voltage – Isolation | 2500Vrms |

| Common Mode Transient Immunity (Min) | 25kV/µs |

| Data Rate | 1Mbps |

| Propagation Delay tpLH / tpHL (Max) | - |

| Pulse Width Distortion (Max) | 145ns, 85ns |

| Rise / Fall Time (Typ) | - |

| Voltage – Supply | 3V ~ 5.5V |

| Operating Temperature | -40°C ~ 105°C |

| Mounting Type | Surface Mount |

| Package / Case | 8-SOIC (0.154″, 3.90mm Width) |

| Supplier Device Package | 8-SOIC |

| Base Product Number | ADUM1250 |

Ⅱ, growth, transformation, coming to China, ADI’s forward-looking development genes

Throughout the history of technology giants, it seems that the starting point of every giant’s growth is related to the warehouse.

In the winter of 1965, two MIT graduates rented a modest warehouse near their school and built their technology empire, brick by brick, starting with the manufacture of high-performance operational amplifiers.

This is how ADI first took shape, and the two graduates with the dream were the co-founders of ADI – Ray Stata and Matthew Lorber.

As you can see from the beginning of the story, in the early days ADI did not make chips, but rather developed discrete devices such as operational amplifiers to produce precisely amplified and improved electrical signals in response to the emerging market of the time.

The turning point came in the 1970s.

At that time, integrated circuit components had only just been introduced and Ray Stata immediately caught the technological trend. He believed that the future of electronics would focus more and more on semiconductor technology and that more core technologies would be integrated to drive the entire electronics industry forward.

With this in mind, Ray Stata is determined to make a semiconductor transformation!

But how can the transformation of a company be so simple? In the opinion of the company’s board of directors, it was too risky to make the transition at a time when ADI’s business was booming and the new market for semiconductors was still too full of unknown variables.

Ray Stata did not stop there.

Due to the huge investment in semiconductors, Ray Stata decided to invest himself in IC design under the pressure of the board of directors, using almost all of his wealth as a bet.

History proved that Ray Stata’s decision was the right one.

In 1971, ADI launched the industry’s first laser-trimmed linear IC FET input op-amp, the AD506, followed by several advanced semiconductor products, signaling the beginning of its transformation.

After the transition, ADI shifted its R&D focus to technologies such as digital-to-analog signal converters, high-performance operational amplifiers, and MEMS devices.

At the same time, with the commercialization of its products, ADI gradually expanded its business to global consumer electronics, wireless communications, and information computing, while its former market position in aerospace and industrial instrumentation was also further consolidated and enhanced.

As the hands of time slipped into the last decade of the last century, the world was in the midst of a dramatic change in the global information age.

In 1995, on the other side of the ocean in the USA, China embarked on a strategic path to become a technological power.

In this context, Ray Stata and his company decided to enter the Chinese market and set up a branch in Beijing in 1995.

This small step by ADI may have seemed at the time to be just riding the wave of the times, testing and exploring new markets. But ADI entered the fast lane of development together with its Chinese partners for the next 25 years. For Zhao Yimiao, it has been a journey of technological innovation and discovery with our partners.

The unique opportunity of the Chinese market is in its speed and volume; ADI values not only the market share but also the needs of this market.

“The speed and volume of all technologies applied in China are different from other countries and regions.” Zhao Yimiao lamented.

In his opinion, the speed of application and innovation of technology in China is much faster than in other countries, and we need to respond with fast speed and also take into account the special requirements of the Chinese market.

Using fingerprint unlocking technology as an example, the market size of China’s electronic locks in 2018 is about 400 million, even if only 10% of the electronic locks are applied to fingerprint unlocking, it will bring a market size of 40 million units.

Based on this unparalleled speed and volume, the importance of the Chinese market to ADI’s overall development cannot be overstated.

“So we have a very strong, very responsive team of application engineers spread across China. We also have corresponding system application engineers in each vertical application area, including solution teams for communication systems, automotive, medical, and consumer industries,” said Zhao Yimiao, “to provide customers with not just chip-based products, but solutions that include the whole system, even together with software.”

Today, ADI’s customer base in China has grown to approximately 4,500 customers and accounts for 22% of total revenue in the Chinese market, showing accelerated growth.

Currently, ADI has a broad business presence in the global market, focusing on six core processing technologies – sensing, measuring, connecting, power, decoding, and security – for analog information, with a comprehensive presence in industrial automation, communications, automotive, and consumer electronics, and medical industries.

Turning to ADI’s just-announced 2019 financial results, the figures show that the company generated about 87% of its revenue last year from B2B markets in the industrial, communications, and automotive industries.

The bulk of the revenue fell on the industrial market, which accounted for half of the total revenue with a 50% share of the revenue. The communications and automotive markets accounted for 21% and 16% respectively.

There is no doubt that industrial, communications, and automotive are the three driving forces behind ADI’s revenue growth and global presence.