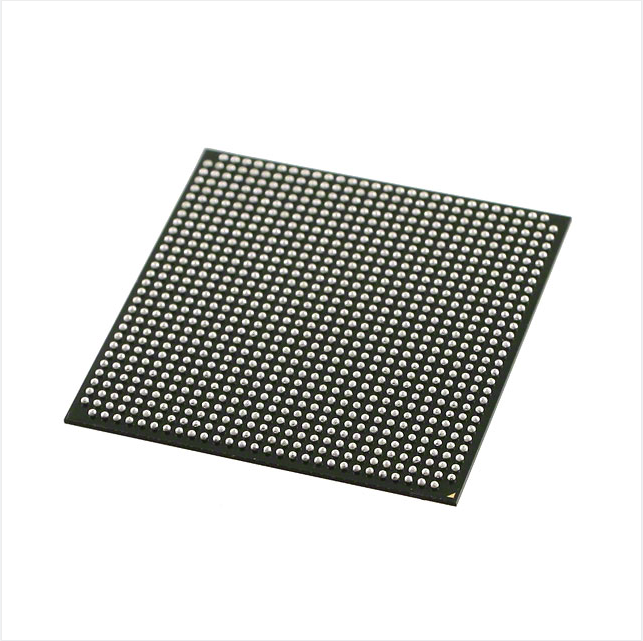

New Original XC7Z015-1CLG485C Inventory Spot Ic Chip Integrated Circuits IC SOC CORTEX-A9 667MHZ 485CSBGA

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)Embedded |

| Mfr | AMD Xilinx |

| Series | Zynq®-7000 |

| Package | Tray |

| Standard Package | 84 |

| Product Status | Active |

| Architecture | MCU, FPGA |

| Core Processor | Dual ARM® Cortex®-A9 MPCore™ with CoreSight™ |

| Flash Size | - |

| RAM Size | 256KB |

| Peripherals | DMA |

| Connectivity | CANbus, EBI/EMI, Ethernet, I²C, MMC/SD/SDIO, SPI, UART/USART, USB OTG |

| Speed | 667MHz |

| Primary Attributes | Artix™-7 FPGA, 74K Logic Cells |

| Operating Temperature | 0°C ~ 85°C (TJ) |

| Package / Case | 485-LFBGA, CSPBGA |

| Supplier Device Package | 485-CSPBGA (19×19) |

| Number of I/O | 130 |

| Base Product Number | XC7Z015 |

Xilinx CEO unveils latest marketing strategy following the acquisition by AMD

Xilinx was acquired by AMD for a staggering US$35 billion, the news of which was announced in October last year, and the shareholders of both sides formally completed the business handover in April this year. The whole transaction process seems to have gone smoothly, with everything moving forward according to the process, but the impact caused is not small, and can be said to have shaken the entire IT industry. I believe that most people, like the author, are curious to know how to integrate the existing business after the merger of the two companies.

“AMD plus Xilinx will bring a strong boost to the high-performance computing market, and we have a very broad portfolio of products that can complement each other.” Victor Peng, President, and CEO of Xilinx gave an online interview to the media to explain in detail the company’s latest strategy and roadmap for future growth.

The merger of the two companies has revolutionized the competitive landscape of the HPC market, as no single company has ever offered such a wide range of product applications. Both CPUs, GPUs, and FPGAs, but also SoC chips and Versal ACAP (software programmable heterogeneous computing platform). Xilinx, in particular, has been dedicated to the data center market for the past ten years or so and has a wealth of experience in the communications, automotive, and aerospace sectors. With AMD’s help, it will allow a strong synergy effect on data center service capabilities. Therefore, both parties are confident of future market performance growth and hope that this extensive market coverage will bring a 1+1>2 effect.

In addition, those who follow Xilinx know that Victor Peng laid out a marketing plan when he first came on board in 2018, which included a data center-first, accelerated core market development, and a computing strategy that drives flexibility and resilience. Three years on, how has Xilinx fared?

Taking adaptive computing to more users

The significant growth that Xilinx has been able to achieve in the data center sector is closely linked to the company’s strategic shift from devices to platforms. It is this major shift that has allowed the company to quickly grow its user base.

In communications, for example, in the traditional core business market and the latest 5G wireless segment, Xilinx has not only introduced adaptive SoCs but also offers a powerful integrated RF radio capability (RFSoC). At the same time, for the growing 5G O-RAN virtual baseband unit market, Xilinx has introduced a dedicated multi-functional telecom acceleration card.

In the wired communications sector in general, and in the mainstream Series time division multiplexing (TDM) and point-to-point (P2P) serial communications technologies in particular, Xilinx has an absolute leadership position. In the field of 400G and even more advanced optical communications, Xilinx has products deployed. Recently, Xilinx also introduced the Versal Premium ACAP device with a 7nm integrated 112G PAM4 high-speed transceiver. For the decomposed O-RAN in 5G, which has been very hot in the past two years, Cyrix also has a related product advancement strategy, working with its partner Mavenior to deploy radio panels with massive MIMO technology.

In addition to the communications market, Xilinx is also involved in more areas such as automotive, industrial, and aerospace, including test measurement and simulation (TME), as well as audio/video and broadcast AVB, and fire protection. Xilinx is currently growing in its core markets, maintaining double-digit growth rates. It has grown 22% in the automotive sector, where shipments of ADAS-oriented automotive-grade devices have accumulated over 80 million units. Growth in the industrial vision, medical, research, and aerospace sectors also reached record levels. For example, earlier this year the U.S. Mars rover “Trail” landed on the surface of Mars, incorporating Xilinx’s technology.

In addition to chips, Xilinx is also at the forefront of a wide range of modular systems and boards. These include the Alveo computing accelerator card, the all-in-one SmartNIC platform, and the Kria SOM Adaptive Module portfolio, to name but a few. Of these, the board range, which had an annual turnover of US$10 million three years ago, is already generating US$100 million in revenue by 2021.

It is safe to say that today, Xilinx is not just a component company, but a platform company more focused on adaptive computing acceleration.

.jpg)