The Yole Group and ATREG today review the fortunes of the global semiconductor industry to date and discuss how the major players need to invest to secure their supply chains and chip capacity.

The last five years have seen significant changes in the chip manufacturing industry, such as Intel losing the crown to two relatively new competitors, Samsung and TSMC. Intelligence Principal Analyst Pierre Cambou had the opportunity to discuss the current state of the global semiconductor industry landscape and its evolution.

In a wide-ranging discussion, they covered the market and its growth prospects, as well as the global ecosystem and how companies can optimise supply. Analysis of the latest investments in the industry and the strategies of leading industry players are highlighted, as well as a discussion of how semiconductor companies are strengthening their global supply chains.

Global Investment

The total global semiconductor market grows from a value of US$850 billion in 2021 to US$913 billion in 2022.

The United States maintains a 41% market share;

Taiwan, China growing from 15% in 2021 to 17% in 2022;

South Korea declining from 17% in 2021 to 13% in 2022;

Japan and Europe remain unchanged - 11% and 9%, respectively;

Mainland China increases from 4% in 2021 to 5% in 2022.

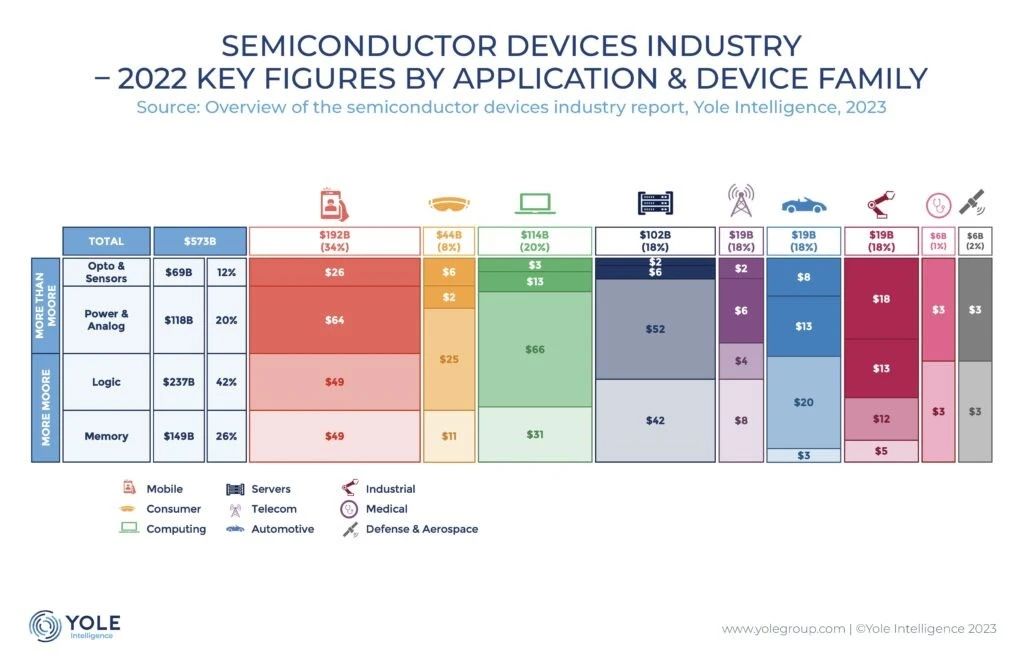

The market for semiconductor devices grows from US$555 billion in 2021 to US$573 billion in 2022.

The US market share grows from 51% in 2021 to 53% in 2022;

South Korea shrinking from 22% in 2021 to 18% in 2022;

Japan's market share increasing from 8% in 2021 to 9% in 2022;

Mainland China increase from 5% in 2021 to 6% in 2022;

Taiwan and Europe remain unchanged at 5% and 9% respectively.

However, the growth in market share of US semiconductor device companies is slowly eroding value-added, with global value-added declining to 32% by 2022. Meanwhile, mainland China has set growth plans worth US$143 billion by 2025.

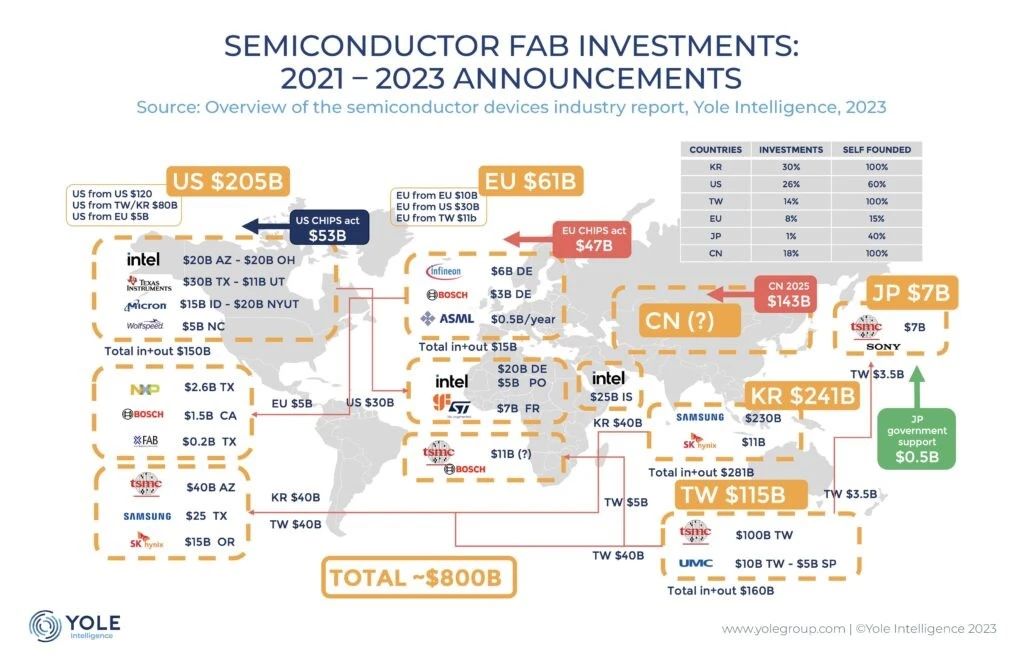

US and EU CHIPS Act

The US Chip and Science Act, passed in August 2022, would provide $53 billion specifically for semiconductors to boost domestic research and manufacturing.

The most recent European Union (EU) CHIPS Act, voted on in April 2023, provides $47 billion in funding which, combined with the US allocation, could provide a $100 billion transatlantic programme, 53/47% US/EU.

Over the past two years, chipmakers around the world have been making record fab investment announcements to attract CHIPS Act funding. Relatively new US company Wolfspeed has announced a $5 billion investment in its 200mm silicon carbide (SiC) plant in the heart of Massinami near Utica, New York, which starts production in April 2022. Intel, TSMC, IBM, Samsung, Micron Technology and Texas Instruments have also embarked on what ATREG describes as an aggressive fab expansion in a bid to get a slice of the US chip bill funding pie.

US companies account for 60% of the country's investment in semiconductors.

Foreign direct investment (DFI) accounts for the rest, said Pierre Kambou, chief analyst at Yole Intelligence. TSMC's $40 billion investment in fab construction in Arizona is one of the most important, followed by Samsung ($25 billion), SK Hynix ($15 billion), NXP ($2.6 billion), Bosch ($1.5 billion) and X-Fab ($200 million).

The US Government does not intend to fund the entire project, but will provide a grant equivalent to 5% to 15% of the company's project capital expenditure, with funding not expected to exceed 35% of the cost. Companies can also apply for tax credits to reimburse 25% of the project's construction costs. "To date, 20 US states have committed more than $210 billion in private investment since the CHIPS Act was signed into law," Rothrock noted. "The first call for CHIPS Act application funding opens at the end of February 2023 for projects to build, expand or modernize commercial facilities for the production of leading-edge, current-generation and mature-node semiconductors, including front-end-end wafer production and back-end packaging plants."

"In the EU, Intel plans to build a $20 billion fab in Magdeburg, Germany, and a $5 billion packaging and test facility in Poland. The partnership between STMicroelectronics and GlobalFoundries will also see a $7 billion investment in a new fab in France. In addition, TSMC, Bosch, NXP and Infineon are discussing an $11 billion partnership." Cambou added.

IDM is also investing in Europe and Infineon Technologies has launched a $5 billion project in Dresden, Germany. "EU companies account for 15% of the announced investments within the EU. DFI accounts for 85%," Cambou said.

When considering the announcements from South Korea and Taiwan, Cambou concluded that the US would receive 26% of total global semiconductor investment and the EU 8%, noting that this allows the US to control its own supply chain, but falls short of the EU's target of controlling 20% of global capacity by 2030.

Post time: Jul-09-2023