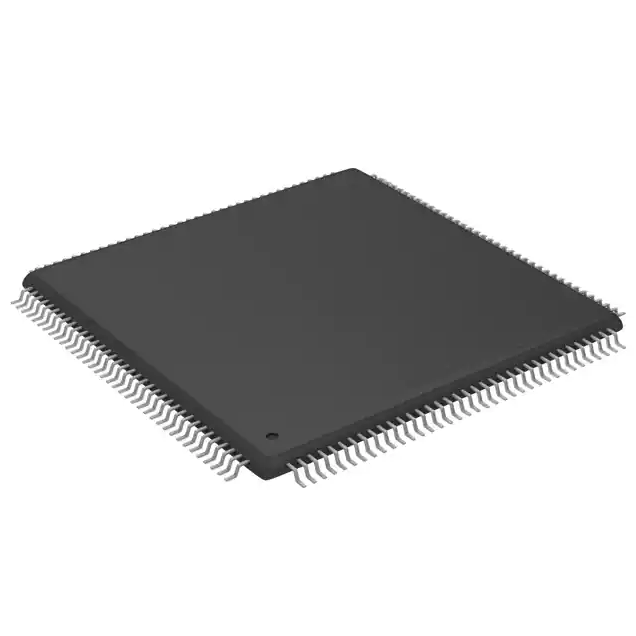

Original New Electronic Components IC Chips Integrated Circuits XC6SLX9-2TQG144C IC FPGA 102 I/O 144TQFP

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)EmbeddedFPGAs (Field Programmable Gate Array) |

| Mfr | AMD Xilinx |

| Series | Spartan®-6 LX |

| Package | Tray |

| Standard Package | 60 |

| Product Status | Active |

| Number of LABs/CLBs | 715 |

| Number of Logic Elements/Cells | 9152 |

| Total RAM Bits | 589824 |

| Number of I/O | 102 |

| Voltage – Supply | 1.14V ~ 1.26V |

| Mounting Type | Surface Mount |

| Operating Temperature | 0°C ~ 85°C (TJ) |

| Package / Case | 144-LQFP |

| Supplier Device Package | 144-TQFP (20×20) |

| Base Product Number | XC6SLX9 |

China approves AMD’s acquisition of Xilinx with 5 conditions!

On 27 October 2020, AMD announced that it will acquire Xilinx (Xilinx) for US$35 billion in an all-stock deal. The deal, while unanimously approved by the boards of directors of both parties, still needs to be approved by shareholders of both parties, with regulatory approval from various countries, including, of course, China.

Recently, the Anti-Monopoly Bureau of China’s State Administration of Market Supervision and Administration announced the decision to approve the anti-monopoly review of the acquisition of a stake in Xilinx by Chaowei Semiconductor Corporation with additional restrictive conditions (the “Announcement”), approving the acquisition of Xilinx by AMD and clearing the final regulatory hurdle for the acquisition.

According to the Announcement, after a year of receiving the anti-monopoly declaration of operator concentration in the case of AMD’s acquisition of Xilinx on January 19, 2021, and filing the case after the applicant supplemented its declaration materials, the General Administration of Market Regulation (GAMR) decided to approve the case with restrictive conditions.

Mergers are allowed, but no bundled sales or discrimination against Chinese customers

It is important to understand that acquisitions with cross-border operations require regulatory approval from several key market regulators around the world. Previously, the US, the UK, and the EU had already cleared the acquisition, and now that China has approved the case, it means that AMD will be able to complete its acquisition plans in the first quarter of 2022.

It should be noted, however, that the approval of AMD’s acquisition of Ceres by the Chinese General Administration of Market Regulation comes with additional restrictive conditions, requiring both parties to the transaction and the post-concentration entity to fulfill the following obligations.

(i) When selling SuperPower CPUs, SuperPower GPUs, and Celeris FPGAs to the market in China, they shall not in any way compel tied sales or attach any other unreasonable trading conditions; they shall not prevent or restrict customers from purchasing or using the above products individually; and they shall not discriminate against customers who purchase the above products individually in terms of service level, price, software features, etc.

(b) Further promote relevant cooperation based on the existing cooperation with enterprises in China and continue to supply Chaowei CPUs, Chaowei GPUs, Xilinx FPGAs, and related software and accessories to the market in China following the principles of fairness, reasonableness, and non-discrimination.

(iii) Ensure the flexibility and programmability of the Xilinx FPGAs, continue to develop and ensure the availability of the Xilinx FPGA product line, and ensure that it is developed in a manner compatible with ARM-based processors and accordance with Xilinx’s plans before the Transaction.

(iv) continue to ensure the interoperability of Chaowei CPUs, Chaowei GPUs and Celeris FPGAs sold to the market in China with third-party CPUs, GPUs and FPGAs; the above level of interoperability shall not be lower than the level of interoperability of Chaowei CPUs, Chaowei GPUs and Celeris FPGAs; information, features, and samples related to the interoperability upgrade shall be provided to the third party within 90 days after the upgrade CPU, GPU, and FPGA manufacturers.

(v) Take measures to protect the information of the third-party CPU, GPU, and FPGA manufacturers and enter into confidentiality agreements with the third-party CPU, GPU, and FPGA manufacturers; store the confidential information of the third-party CPU, GPU, and FPGA manufacturers in separate and mutually exclusive hardware systems.

Supervision and enforcement of the Restrictive Conditions In addition to this announcement, the additional Restrictive Conditions Undertaking Proposal submitted by Chaowei to the Market Supervision Authority on 13 January 2022 is legally binding on the Parties to the Transaction and the Post-Concentration Entity. From the Effective Date, the Parties to the Transaction and the Post-Concentration Entities shall report to the AQSIQ on the implementation of this Undertaking Proposal on a half-yearly basis.

After six years after the Effective Date, the Post-Concentration Entity may submit an application to the General Administration of Market Supervision for the release of the conducive conditions. The General Administration of Market Supervision (GAMS) will decide whether to lift it upon application and in light of the competitive situation in the market. The post-concentration entity shall continue to comply with the restrictive conditions without the lifting being approved by the General Directorate of Market Supervision.

The General Directorate of Market Supervision is entitled to monitor the fulfillment of these obligations by the parties to the transaction and the post-concentration entity, either through the supervisory trustee or on its own. If the parties to the transaction and the post-concentration entity fail to fulfill or breach the above obligations, the General Administration of Market Supervision will take action by the relevant provisions of the Anti-Monopoly Law.

.jpg)