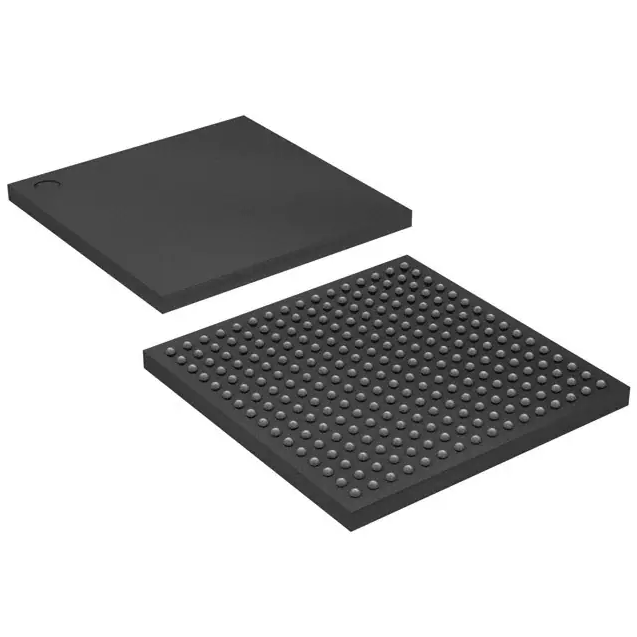

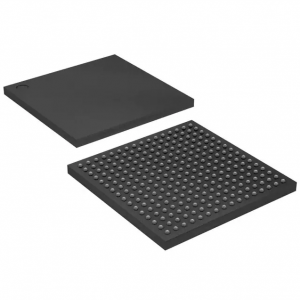

XC7A15T-2FTG256I IC Integrated Circuits Electronic components IC FPGA 170 I/O 256FTBGA

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)Embedded |

| Mfr | AMD Xilinx |

| Series | Artix-7 |

| Package | Tray |

| Standard Package | 90 |

| Product Status | Active |

| Number of LABs/CLBs | 1300 |

| Number of Logic Elements/Cells | 16640 |

| Total RAM Bits | 921600 |

| Number of I/O | 170 |

| Voltage – Supply | 0.95V ~ 1.05V |

| Mounting Type | Surface Mount |

| Operating Temperature | -40°C ~ 100°C (TJ) |

| Package / Case | 256-LBGA |

| Supplier Device Package | 256-FTBGA (17×17) |

| Base Product Number | XC7A15 |

As one of the branches of logic chips, FPGA (Field-Programmable Gate Array) chips are based on programmable devices (PAL, GAL) and are semi-customized, programmable integrated circuits, known as “universal chips”. FPGAs have the advantages of field programmability (high flexibility), short time-to-market (save on flow cycles), lower cost than fully customized ASICs (save on flow costs), and greater parallelism than general-purpose products.

FPGAs are used in a wide range of downstream applications and demand is growing steadily, mainly covering network communications (5G), industrial IoT, consumer electronics, data centers, automotive electronics (autonomous driving), artificial intelligence (AI), and other fields. Among them, network communications, consumer electronics, and automotive electronics are its main application scenarios, accounting for more than 80% of the total demand. In the future, driven by the demand for high computing power in 5G, AI, data centers and autonomous driving, the growth of the FPGA chip market demand is certain. In addition, as Intel, AMD and other companies gradually combine CPUs with FPGAs in high-calculus scenarios and increase their investment in heterogeneous computing, the global FPGA market will further open up. According to Frost & Sullivan, the global FPGA market is expected to reach US$12.58 billion by 2025, with an average CAGR of 11% over 16-25 years.

Compared to CPUs, GPUs, ASICs, and other products, FPGA chips have higher profit margins. It is reported that the profit margin of low and medium-density million gate level and 10-million gate level FPGA chip R&D enterprises are close to 50%, and the profit margin of high-density billion gate level FPGA chip R&D enterprises is nearly 70%. As shown in the chart below, Xilinx’ gross margin in the past ten quarters has remained above 65%, higher than the gross margins of Nvidia and AMD in the same period.

FPGAs have high barriers to entry and require collaborative hardware and software development: FPGAs have high technical barriers to dedicated EDA software, complex hardware structures, and low yields, so the global FPGA market is always in a duopoly competition pattern, with the top four giants being Xilinx, Intel (Altera), Lattice and Microchip, with CR4 ≥ 90%. Among them, Xilinx’s market share in the global FPGA market is always above 50%, the Top1 concentration is second only to the PC CPU and GPU market, and together with Intel (Altera) account for more than 80% of the FPGA market share, the industry horsepower effect is obvious.

Two important indicators for FPGAs: process technology and logic gate density

The demand structure for FPGAs is still dominated by 28nm or higher processes and 100K or fewer logic cells.

In terms of process, 28-90nm FPGA chips are dominant due to their high-cost performance and yield. The advanced process has lower power consumption and higher performance, and it is expected that FPGA chips with a sub-28nm process will enter a period of rapid development. In terms of logic gate density, the demand for FPGA chips with less than 100K logic cells is currently the largest, followed by the 100K-500K logic cell segment.

As the largest market for Xilinx, Asia Pacific (especially China) has a significant impact on the company’s revenue. According to Frost & Sullivan, the China FPGA market in terms of sales in 2019 is 63.3% and 20.9% for 28-90nm process, and 20.9% for sub-28nm process FPGAs, respectively; and 38.2% and 31.7% for sub-100K logic cells, and 100K-500K logic cells, respectively.

Benefiting from the evolution of technologies such as 5G, AI, and autonomous driving, as well as the development of data centers, to drive market expansion, FPGA leader Xilinx has achieved a V-shaped revenue reversal in the past two years. Celeris FY22Q2 revenue increased 22.1% year-on-year to US$936 million; gross profit increased 16.7% year-on-year to US$632 million; net profit increased 21% year-on-year to US$235 million.

As of the close of 11/1/22, Xilinx is up 49.84% in Y21 and -5.43% in Y22 so far, underperforming the S&P 500 ETF (SPY: -1.1%), Philadelphia Semiconductor Index (SOXX: -2.04%) and Nifty 100 ETF (QQQ: -3.02%) over the same period.

.png)