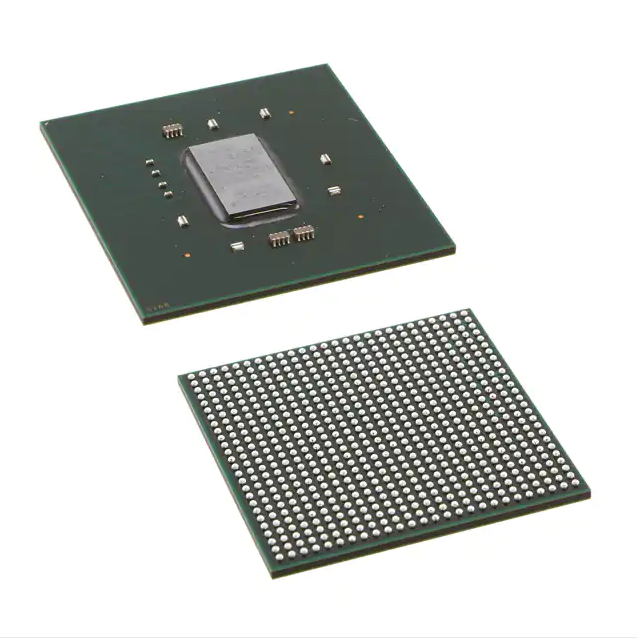

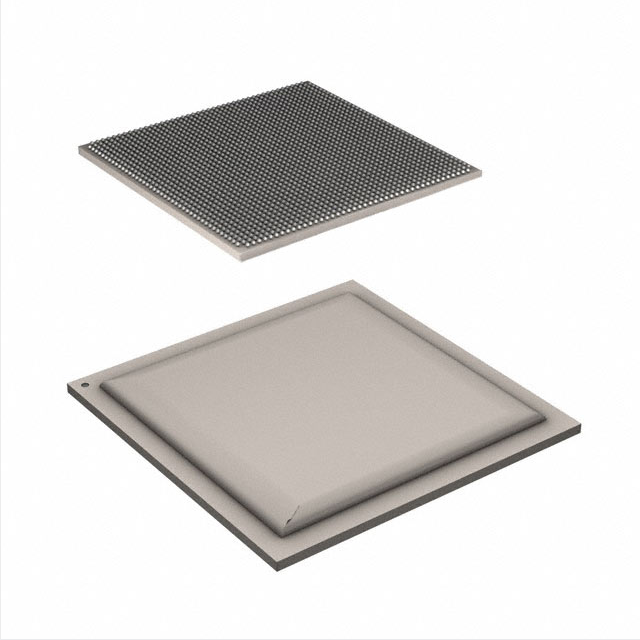

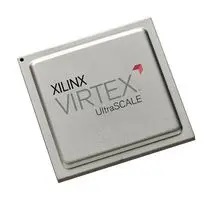

XC7K325T-1FBG676I 676-FCBGA (27×27) integrated circuit IC FPGA 400 I/O 676FCBGA electronics components

Product Attributes

| TYPE | DESCRIPTION |

| Category | Integrated Circuits (ICs)EmbeddedFPGAs (Field Programmable Gate Array) |

| Mfr | AMD Xilinx |

| Series | Kintex®-7 |

| Package | Tray |

| Standard Package | 1 |

| Product Status | Active |

| Number of LABs/CLBs | 25475 |

| Number of Logic Elements/Cells | 326080 |

| Total RAM Bits | 16404480 |

| Number of I/O | 400 |

| Voltage – Supply | 0.97V ~ 1.03V |

| Mounting Type | Surface Mount |

| Operating Temperature | -40°C ~ 100°C (TJ) |

| Package / Case | 676-BBGA, FCBGA |

| Supplier Device Package | 676-FCBGA (27×27) |

| Base Product Number | XC7K325 |

Why is the car chip in the lack of core tide to bear the brunt?

From the current global chip supply and demand situation, the chip shortage problem is difficult to solve in the short term, and will even intensify, and automotive chips are the first to bear the brunt. Distinguished from consumer electronics chips, currently widely used automotive chips, its processing difficulties are higher, second only to military grade, and the life of the automotive grade chips often must reach 15 years or more, a car company’s host plant in the selected automotive chips, and will not be easily replaced.

From the market scale, the global automotive semiconductor scale in 2020 is about $46 billion, accounting for about 12% of the overall semiconductor market, smaller than communications (including smartphones), PC, etc… However, in terms of growth rate, IC Insights expects a global automotive semiconductor growth rate of about 14% in 2016-2021, leading the growth rate in all segments of the industry.

The automotive chip is further divided into MCU, IGBT, MOSFET, sensor, and other semiconductor components. In conventional fuel vehicles, MCU accounts for up to 23% of the value volume. In pure electric vehicles, MCU accounts for 11% of the value after IGBT, a power semiconductor chip.

As you can see, the main players in the global automotive chip me are divided into two categories: traditional automotive chip makers and consumer chip makers. To a large extent, the actions of this group of manufacturers will play a decisive role in the production capacity of the back-end car companies. However, in recent times, these head manufacturers have been affected by various events that have affected the supply of chips, synchronously leading to a chain reaction of supply and demand imbalance across the industry chain.

On 5 November last year, following the decision by STMicroelectronics (ST) management not to give employees a pay rise this year, the three main French ST unions, CAD, CFDT, and CGT, launched a strike at all French ST plants. The reason for the non-pay rise was related to the New Coronavirus, a serious epidemic in Europe in March this year, and in response to workers’ concerns about contracting the New Coronavirus, ST had reached an agreement with French fabs to reduce factory production by 50%. At the same time also caused higher costs for the prevention and control of the epidemic.

In addition, Infineon, NXP because of the impact of the United States super cold wave, the chip factory located in Austin, Texas, to complete shutdown; the Renesas Electronics Naka factory (Hitachi Naka City, Ibaraki Prefecture, Japan) fire caused serious damage to the damaged area is a 12-inch high-end semiconductor wafer production line, the main production of microprocessors to control car driving. It is estimated that it may take 100 days for chip output to return to pre-fire levels.