XC7Z007S-2CLG225E IC SOC CORTEX-A9 766MHZ 225BGA new & original in chips integrated circuits electronics one spot buy

Product Attributes

| TYPE | DESCRIPTION |

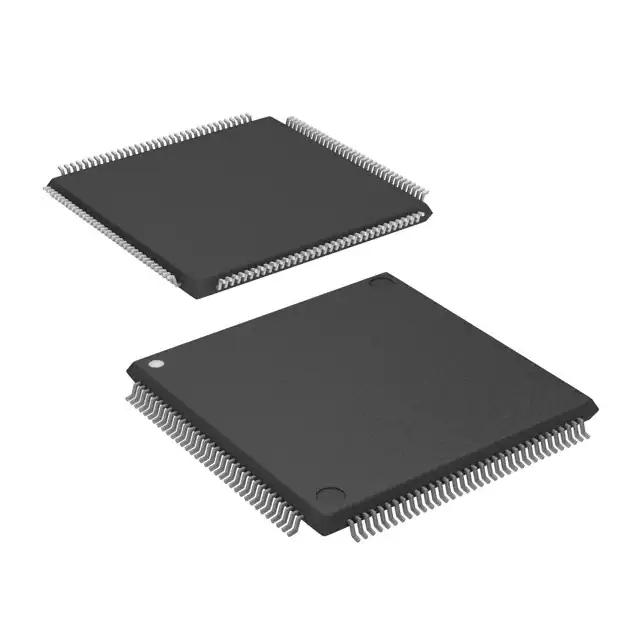

| Category | Integrated Circuits (ICs) |

| Mfr | AMD Xilinx |

| Series | Zynq®-7000 |

| Package | Tray |

| Standard Package | 160 |

| Product Status | Active |

| Architecture | MCU, FPGA |

| Core Processor | Single ARM® Cortex®-A9 MPCore™ with CoreSight™ |

| Flash Size | - |

| RAM Size | 256KB |

| Peripherals | DMA |

| Connectivity | CANbus, EBI/EMI, Ethernet, I²C, MMC/SD/SDIO, SPI, UART/USART, USB OTG |

| Speed | 766MHz |

| Primary Attributes | Artix™-7 FPGA, 23K Logic Cells |

| Operating Temperature | 0°C ~ 100°C (TJ) |

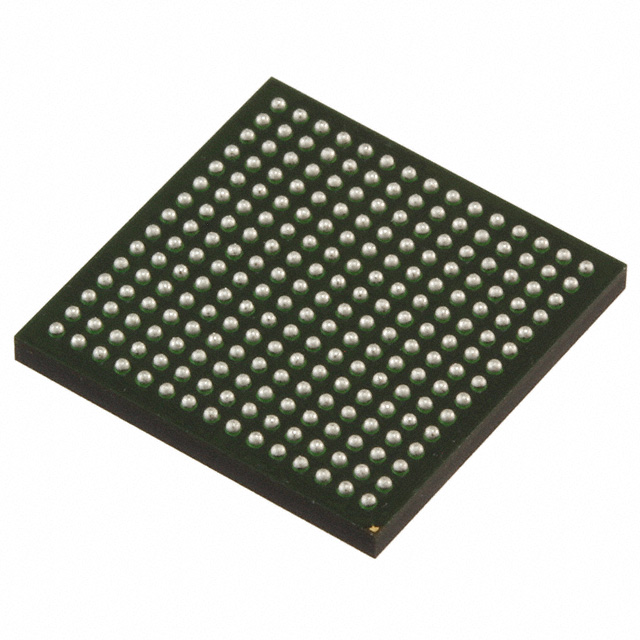

| Package / Case | 225-LFBGA, CSPBGA |

| Supplier Device Package | 225-CSPBGA (13×13) |

| Number of I/O | 54 |

| Base Product Number | XC7Z007 |

After the merger, AMD is expected to become a top 10 global semiconductor company

According to publicly available information, Xilinx is a US-based manufacturer of programmable logic devices whose business focus is dedicated to entering the data center market with programmable chips that help accelerate film compression or provide specialized tasks such as digital encryption. The company has become a leading company in this field thanks to its invention of field-programmable gate array (FPGA) microchips that can be reprogrammed after production.

Previously, AMD President and CEO Zifeng Su noted that the acquisition would bring an exceptional team to AMD, which, by effectively integrating Xilinx’s strengths in FPGAs, can offer a computing portfolio with broader high-performance, providing system-level solutions from CPUs to GPUs, ASICs, and FPGAs. At the same time, with the resources of Xilinx in 5G, communications, autonomous driving, and industry, AMD can bring high-performance computing capabilities to more areas and expand to a broader customer base.

In other words, after AMD acquires Xilinx, it is highly likely that Xilinx’ FPGAs will be integrated into its existing CPU processors, GPU graphics cards, and accelerated computing cards, thus forming a complete high-performance computing system.

However, it is worth noting that Intel, another major player in the FPGA market, spent US$16.7 billion to acquire Altera in 2015, on which it established the Programmable Division.

Also, in the data center market, NVIDIA’s strength should not be underestimated, as its acquisition of Israeli chip manufacturing company Mellanox in March 2019 has greatly enhanced its core competencies in this market, and based on Mellanox’s hardware base, it has developed two DPUs in the BlueFeild series, namely the Bluefield-2 DPU and Bluefield-2X DPU.

In this regard, some industry insiders believe that the acquisition of Xilinx will give AMD an advantage in competing with Intel and Nvidia and give it a greater position in the fast-growing telecommunications and defense markets.

AMD’s acquisition of Xilinx is inextricably linked to its rapid growth over the years. AMD has long been Intel’s main competitor in the CPU market. Ever since Zifeng Su took over as CEO of AMD in 2014, it has continued to challenge Intel in the fast-growing data center market. A few years ago, AMD’s market capitalization was almost on par with Xilinx, but as AMD’s products continue to give, it has allowed its share price to climb.

According to a teaser released by AMD recently, the company will release its fourth quarter and full-year financial results for 2021 on February 1, 2022, which is also the first day of the Chinese New Year. 2021, AMD said, will also be the best year in AMD’s history, despite the impact of the global epidemic. According to previous forecasts, AMD’s full-year revenue growth was 60%, although the growth rate has been revised up to 65% in the third quarter.

In addition, AMD is on track to achieve revenue of $9.76 billion, operating income of $1.37 billion, net income of $2.49 billion, and diluted earnings per share of $2.06 in 2020. If this is calculated, AMD’s revenue may exceed US$16 billion in 2021.

It is thus foreseeable that after the merger between AMD and Xilinx, AMD will be expected to enter the top 10 semiconductor companies in the world.